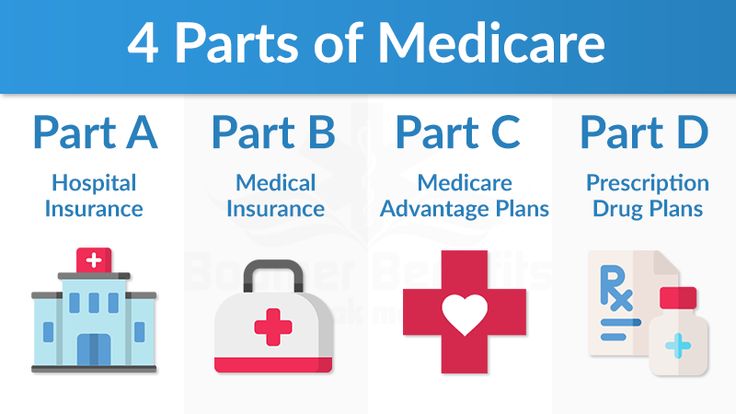

Medicare is divided into several different parts.

Original Medicare includes Part A and Part B.

You can choose to enroll into either Original Medicare, which consists of Parts A and B, and add a Medicare Supplemental Plan and a Stand Alone Part D plan or you can enroll into a Medicare Part C Plan (also called Medicare Advantage). In most cases, you’ll need to use doctors who are in the plan’s network with a Medicare Advantage plan.

For more information about the basics of Medicare click here.

Medicare Part A

Medicare Part A is commonly considered hospitalization insurance. Part A covers costs related to:

Medicare Part B

Medicare Part B provides for the rest of your non-hospitalization healthcare needs. Under Part B you receive coverage for:

Medicare Part C

Medicare Part C, or Medicare Advantage is designed to roll the coverage of Part A and B into one plan, offered by a private health insurance company that contracts with Medicare. By law, Medicare Advantage plans must offer at least the same coverage as Original Medicare. Other rules may differ, or the network might offer additional benefits. Many Medicare Advantage plans also include Part D prescription drug coverage.

Medicare Part D

Medicare Part D is known as the Prescription Drug Plan. Part D covers costs related to medications.

As you can see, Medicare is available in different “parts”, all of which are designed to fit together to offer comprehensive coverage. When you choose to stay with Original Medicare, you will need to find a Medi-gap or Medicare Supplemental plan with a stand-alone Prescription Drug plan to help fill the gap that Original Medicare doesn’t cover.

Medicare Supplemental (Medigap) plans are offered thru private insurance companies. These policies are standardized and in most states named by letters like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Still have questions? Schedule a no-cost appointment and we will help you! Choosing insurance can be hard. We make it easy!